Digital Payments: Everything You Need To Know

Financial institutions have had a lot to deal with, from changing consumer payment habits to dealing with issues that existed before the pandemic, not to mention the need to modernise their payment solutions to support new payment methods and rails. Every bank is debating two topics in particular: the cloud and real-time payments. Gareth Lodge, Senior Analyst, Global Payments at Celent, discussed how banks should approach this opportunity to be at the forefront of change in a webinar with Alacriti.

Say goodbye to jingly pockets, stuffed wallets with creased bills, and chequebooks. Cash and paper checks are being phased out of payments. According to a Federal Reserve study, the number of payments made via an automated clearing house (ACH) transfers surpassed check payments in 2018. That is the first time that has occurred.

Businesses that do not accept electronic payments risk losing customers and falling behind as digital payments become more common. But what information do you need to know about electronic payments?

History Lesson Time!

2020 changed where we do business and how we pay for things, which dramatically altered bank revenues. The Coalition Transaction Banking Index revenue showed that cash management was the hardest hit. As a result, there was a lot of pressure to cut costs and find new revenue streams.

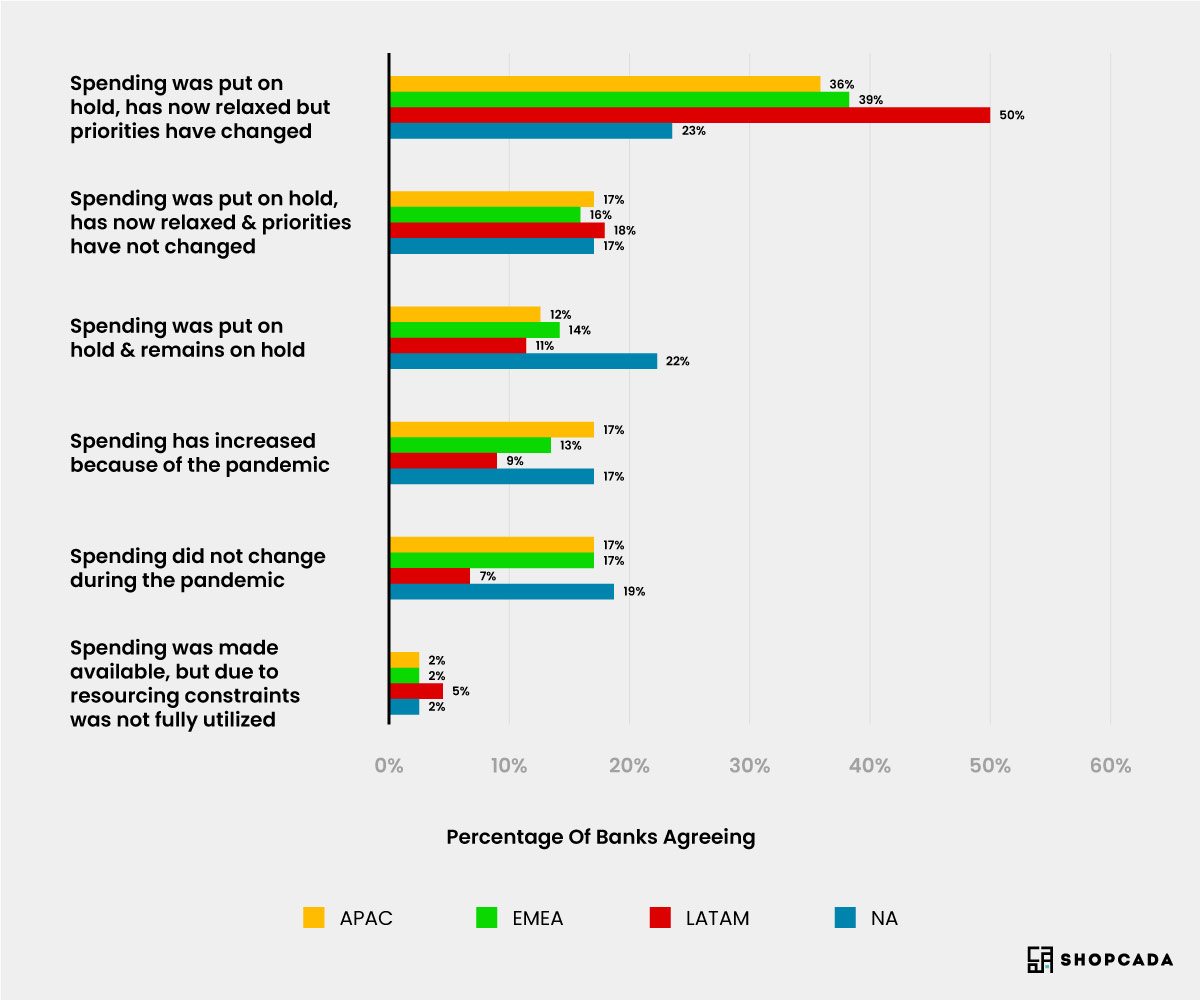

Celent conducted a large global survey (The State of the Nations for Payments Modernization) of 200 banks from around the world. The survey results chart (below) shows how banks responded when asked how COVID-19 affected their investment in payments technology. By late May 2021, 22% of US banks reported that IT spending was on hold, with another 23% reporting that their budget priorities had shifted.

Banks discovered that some of their digital processes were not as digital as they had assumed (e.g., the ability to allow customers to open and close bank accounts remotely). So they entered 2022 with a backlog of items that should have been completed over the previous two years and an increasing list of things to do as a result of the previous two years.

What Are Electronic Or Digital Payments?

A customer is making an electronic payment for a good or service rather than physically exchanging cash or a paper check. Electronic prices are common among e-commerce merchants who conduct business online and require customers to pay online.

Businesses, on the other hand, accept debit or credit cards in person for electronic payments.

Payment Types

Let's take a broader look at electronic payments. These payments typically fall into one of two categories:

-

One-time payments: As the name implies, this is a single payment made once. A customer making a one-time electronic payment would be purchasing a cake from a bakery with a credit card.

-

Recurring payments: If a customer payment is made electronically regularly, it can be processed automatically on a predetermined date. Consider the following scenario: you provide monthly website maintenance to your clients. As a result, you could withdraw a predetermined payment from their bank account on the last working day of each month.

Now that you've learned about the various payment frequencies, let's look at the other electronic payment methods:

Debit Cards & Credit Cards

Debit and credit cards are the most commonly used electronic payment methods. Credit cards are responsible for 23% of all payments, while debit cards are responsible for 28% of all charges.

To make these payments, either the card is swiped at a POS system or the payment information is entered manually during the checkout process.

A debit or credit card processing fee must be paid by the business owner. Each transaction incurs fees ranging from 1.5% to 3.5%. Credit and debit card payments, on the other hand, often clear into your bank account faster than other electronic payment options.

eChecks

An eCheck payment from a customer is similar to a traditional paper check.

What's the difference?

Instead of filling out that sheet of paper, they enter their bank account information, primarily their routing and account numbers, into a website. This is also known as a "direct debit" because the money is taken directly from their bank account to pay for the transaction.

You won't get the money right away, so keep in mind that banks can take several days to process and clear this type of payment.

ACH Transactions

ACH, or automated clearing house, is another popular type of electronic payment. In reality, we saw over 24 billion ACH transactions in 2019 alone.

It works by first having a centralised system which transfers funds between bank accounts instantly in an ACH transfer (called the ACH network). Direct deposit, for example, is a type of ACH transfer because it involves money moving directly from your business account to your employees' accounts.

Although there is a fee for processing ACH payments, it is frequently less expensive than credit or debit card processing fees. These fees could be charged in the form of a batch fee, a flat fee per transaction, a percentage fee, or a monthly fee. The percentage usually ranges between 0.5 and 1.5%.

Benefits?

The world of payments is becoming increasingly cashless, and according to a survey of Americans, 58% believe the country should transition to an entirely cashless economy.

But why? Electronic payments, on the other hand, have several advantages for both consumers and businesses.

Increased Comfort & Efficiency

Electronic payments are simple and quick for the customer. This is critical because customers want more convenience.

From a business standpoint, you may also use electronic payments more quickly. These payments are automatically transferred to your POS software, streamlining your bookkeeping and removing the need for many manual entries.

Also, having the mere presence of mind to help by giving your customers the option of saving their card information on-site can speed up the checkout process. This makes things easy for customers whether it’s an impulse buy or a purchase that they’ve been mulling on for several months. Both of these can benefit from not giving customers additional precious seconds to reconsider their decisions while keying in their credit card information.

This makes it easier for businesses with the speedy clearing of stocks and easy payment verification…which can be seen from Amazon’s single click buy now button that skips a lot of the checkout hassle…its success, on the other hand, we feel, is self-explanatory.

Sales!

Accepting electronic payments requires you to pay processing fees, which can be intimidating. Even with the additional cost, providing these various payment options can benefit your company's bottom line.

Many experts believe that when using a credit card instead of cash, consumers are more willing to spend money. In a classic study, two MIT professors tested this hypothesis by dividing participants into two groups.

For basketball tickets, one group had to pay cash, while the other had to use a credit card. Prepared the group buying tickets with a credit card to pay twice as much as the group buying tickets with cash.

Better Customer Relationships

Customers now want more options than ever before. This is true for payment options as well as brand, product, and service selection.

You risk alienating customers and ruining their purchasing experience if you force them to use a specific payment method. 42% of American customers will abandon a purchase if their preferred payment method is not accepted.

Accepting electronic payments provides consumers with the variety they desire, increasing your chances of closing more sales. Whichever of the aforementioned electronic payment options your customer chooses, they all work in the same way.

To process electronic payments, electronic funds transfers are used (EFT). It is exactly what it sounds like: money is transferred electronically from one account to another.

What makes that different from an ACH transfer? After all, an ACH transfer is a type of EFT. ACH transfers, debit or credit card payments, eCheck purchases, and wire transfers are all examples of EFTs.

The main takeaway is that funds are electronically transferred from bank account A to bank account B. However, depending on the electronic payment method used, there are numerous participants and moving parts in this process.

You should be familiar with the following payment processing terms:

-

Gateways: These are an intermediary between the point of sale and the bank. Between the merchant account and the payment processor, the payment gateway sends encrypted payment data.

-

Payment Processors: This collects payment information from the payment gateway, examines it, and decides whether or not to accept the payment. In many payment systems, the payment processor and gateway are combined.

-

Merchant Accounts: A merchant account is required to accept credit card payments. When a customer pays with a credit card, the funds are transferred to your merchant account and processed by a third party. Once processed, the funds are transferred from the merchant account to your regular business bank account.

Now that you know who is involved in the process, let's go over how it works. A simplified rundown here assumes that you have an e-commerce site where customers can purchase your handmade candles:

-

A customer uses their credit card to purchase a variety pack of your scented candles from your website.

-

Their payment information is received by the payment gateway. The payment gateway encrypts the customer's credit card information before sending it to the payment processor.

-

Before approving the transaction, the payment processor double-checks those details to ensure they are correct.

-

The payment processor notifies the payment gateway when a payment is accepted.

-

After sending the customer a confirmation page or "success" message, you fulfil their candle order.

-

Despite what appears to be a lot of information being exchanged, the entire payment process is completed in a matter of seconds.

How It Works: Detailed Version

In reality, the method by which digital payment methods work is determined by the platform used to process the payments. So, for example, if you are currently processing payments with PayPal, your experience will be very different from that of another payment processing merchant.

Let's look at the four major stages of the digital payments process in more detail.

Payment Authorisation

At this point in a digital payment transaction, the cardholder initiates a sale by requesting that the merchant authorise payment from the customer's bank.

If there are sufficient funds to cover the transaction and the payment is not identified as fraudulent, the bank grants payment authorization.

The merchant proceeds with the sale after receiving authorization from various relay points within seconds. The sale, however, is not final until the remaining steps in the process are completed.

Payment Batching

Simply put, merchants do not find it efficient to process payments one at a time. Instead, batching payment data is far more efficient.

The batching process also allows merchants to review each transaction to ensure that the order is correct and that there are no signs of fraud. If a merchant suspects fraud, he or she may cancel the transaction.

The significance of fraud detection cannot be overstated. A company may face not only a loss of reputation and potential fines but also several ongoing chargeback fees.

Payment Clearing

The merchant accepts batch transactions during the clearing stage of the payment processing cycle. When they arrive, they are processed and forwarded to the card networks. The payment will then be accessed by the card networks and forwarded to the merchant.

The merchant charges the cost to the customer's card account, and the funds are then routed back through the customer's card network.

Payment Funding

The final step in the procedure is funding. At this point, the funds are transferred from the initiated account to the merchant's account as a transaction. In most cases, both the depositor and the receiver are charged fees for the final transaction.

As a merchant, your final total will be the transaction total minus the associated fees. The following are the most common fees:

-

Payment of exchange fees to the issuer.

-

Card networks charge assessment fees.

-

The digital payment processor charges processing fees.

Most merchants can expect this process to take between 24 and 48 hours to complete.

Accepting E-Payments: How To?

You want to be able to accept electronic payments. What happens next? It is relatively easy to get started. You must complete the following tasks:

-

Open a merchant account: You must do this regardless of which payment gateway or processor you use to accept card payments. Begin by discussing your options for a merchant account with your current bank. Inquire with your bank about receiving ACH payments at the same time and whether there are any fees involved.

-

Invest in the proper equipment: Payment processing and a payment gateway are required. Remember that many platforms, such as QuickBooks Payments, combine both tools into a simple solution.

-

Allow electronic payments at the checkout: Allow clients to pay once they've completed the necessary steps.

Depending on the nature of your business, this could entail integrating a card reader into your POS system to enable in-person electronic payment acceptance.

Using an invoicing solution that allows you to enable a variety of electronic payment methods so that customers can pay an invoice in the way that is most convenient for them. Making an online storefront with the ability to accept various types of electronic payments from customers.

Why Does Your Business Need To Seriously Consider Accepting E-Payments?

Each year, businesses in North America send and receive $27 trillion in business-to-business payments, but they also incur an estimated $510 billion in manual accounts payable costs.

One of the primary causes of these exorbitant prices is that at least 60% of payments are still made with paper checks. Most financial leaders recognise the importance of transitioning to electronic payment systems, but many are unsure where or how to begin.

Simply processing 500 check payments per month would consume an entire workday for businesses that do so. After switching to an e-payment platform, most businesses saw a reduction in the processing time of fewer than two hours.

Each paper check transaction typically costs $5, whereas an e-payment can save up to 80% on processing costs.

Electronic payments not only reduce costs but also aid in risk management. Buyers want to properly manage their working capital and understand their purchasing.

Vendors are curious about the payment status and the estimated delivery date. Both parties want the potential visibility to back up any arguments they make. Organisations can avoid the hassle and risk of paper checks by integrating electronic payment solutions into their accounts payable operations.

Closing Words

Year after year, the importance of m-commerce and e-commerce grow. Customers become accustomed to quick, simple, and uncomplicated payments.

They want convenience and become impatient and easily discouraged when additional work is required. The fact that they perceive comfort differently is even more telling.

Some people prefer credit cards, while others prefer specialised or regional payment methods. Implementing multiple e-payment systems is thus an absolute must. In either physical or online stores.

You can increase your sales and meet your client's expectations by providing them with the e-payment solutions they expect.